Civil Aviation

Objective

Enhance the affordability of flying to enable an

increase in domestic ticket salesfrom 103.75 million in 2016-17 to 300 million by 2022.Double air cargo handledfrom about 3.3 million tonnes in 2017-18 to about 6.5 million tonnes.Expand the maintenance, repair and overhaul (MRO) industryfrom USD 1.8 billion in 2017 to USD 2.3 billion.Expand airport capacitymore than five times to handle one billion trips a year.Enhance availability and affordability of regional air connectivity and revive/upgrade 56 unserved airports and 31 unserved helipads through the Regional Connectivity Scheme –

Ude Desh Ka Aam Naagrik (RCS-UDAN).Ensure that airport tariffs, taxes on fuel, landing charges, passenger services, cargo and other charges are determined in an efficient, fair and transparent manner.

Current Situation

The civil aviation sector contributed USD8.9 billion to India’s GDP in 2014 and supported 1.31 million direct, indirect and induced aviation jobs. In 2016, the demand for domestic air travel was twice that in China. India’s domestic air traffic made up 69 per cent of total airline traffic in South Asia.5 The World Economic Forum’s Global Competitiveness Report, 2018 ranks India as 53rd out of 140 countries worldwide in air transport infrastructure.

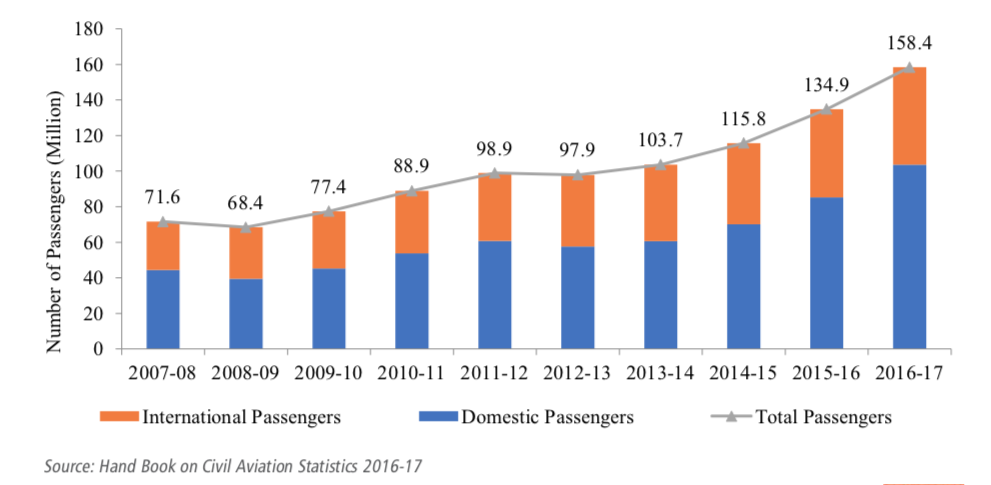

Figure 15.1: Passenger traffic by scheduled carriers, 2007-08 to 2016-17

Note: Image taken from Niti Aayog - Strategy for New India@75 Document

Note: Image taken from Niti Aayog - Strategy for New India@75 Document

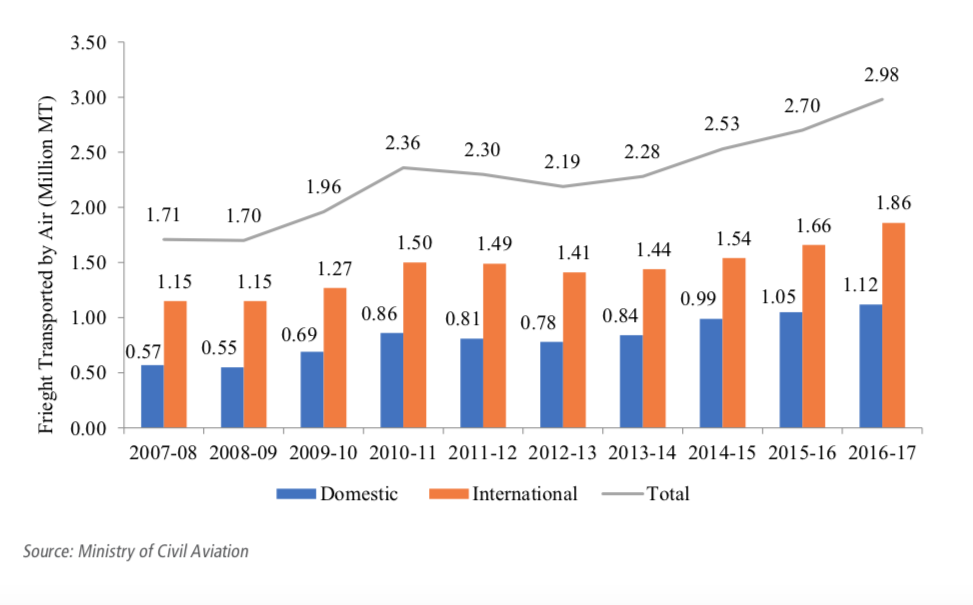

Figure 15.2: Freight transported by air, 2007-08 to 2016-17

Note: Image taken from Niti Aayog - Strategy for New India@75 Document

Note: Image taken from Niti Aayog - Strategy for New India@75 Document

2018 ranks India as 53rd out of 140 countries worldwide in air transport infrastructure.

The Airport Authority of India (AAI) aims to bring around 250 airports under operation across the country by 2020. The Ministry of Civil Aviation’s regional connectivity scheme, UDAN, is a 10-year scheme, which will promote balanced regional growth and make flying affordable for the population. It will help enhance connectivity to the country’s unserved and underserved airports.

India’s civil aviation sector has been growing steadily; the number of passengers was 158 million in 2016-17. Domestic passenger traffic increased at a CAGR of almost 10 per cent between 2007-08 and 2016-17 and international passenger traffic grew at a CAGR of 8.07 per cent during the same period. Between 2014-15 and 2016-17 in particular, traffic growth in the domestic passenger segment was 48 per cent and 20 per cent in the international segment. India is also catching up with other leading aviation markets in terms of market penetration.

There has been an increase in air cargo, both domestically and internationally, in 2016-17. IATA has forecast that India will cross over into the top 10 air freight markets in 2018-19

Constraints

Capacity and infrastructure: Due to the rapid expansion of India’s civil aviation sector, airspace, parking bays and runway slots will become increasingly scarce over the next few years, especially at metro airports.

Mumbai and Chennai airports are already close to saturation. Capacity and infrastructure constraints could decrease efficiency and safety and have negative economic effects. Inadequate hangar space and unavailability of land to expand airports at their current sites, particularly in major cities, are two of the major constraints that face the sector. While this may be less binding in metro cities where the number of passengers is large enough to support more than one airport, building more than one airport is not feasible in non-metro cities because of low passenger volume.Skilled workers: According to a study conducted by the Ministry of Civil Aviation, Indian aviation could directly support 1.0 to 1.2 million jobs by 2035. This implies that about 0.25 million persons will need to be skilled over the next 10 years.

Shortage and gaps in availability of industry-recognised skills– from airline pilots and crew to maintenance and ground handling personnel – could constrain the growth of different segments of the sector.Aviation Gasoline (AvGas)is used as fuel by almost all training aircraft. This fuel is imported, its supply is not assured and it attracts a tax of 18 per cent (earlier 28 per cent) under GST. Coupled with a shortage of instructors, this makes flying training an expensive and time-consuming exercise.

High cost to passengers and of air cargo:

Tariff determination: The Ministry of Civil Aviation has mandated that all airports move from a single to a hybrid till structure. Although this is beneficial as it incentivizes infrastructure investment, it raises costs for airlines and passengers.

Taxes on aviation turbine fuel (ATF): Due to high taxes and lack of competition among providers, ATF is relatively expensive in India. Since it remains outside the GST network, there are also regional disparities in its price. The price of aviation fuel in India may be up to 60 per cent per cent higher than prices in ASEAN and the Middle East countries because of high central and state taxes.

Fuel cost as a percentage of operating charges amounts to 45 per cent11 in India as compared to the global average of 30 per cent.Incidence of GST on Aircraft Leases and Spare Parts: GST of 5 per cent is applied on aircraft lease rentals; GST ranges between 5 per cent and 28 per cent on aircraft engines and spare parts. This also raises costs for the sector.

Aviation safety: Although, the number of aviation safety violations in 2017 (337) has declined in comparison to 2016 (442), the absolute number still remains high.

Way Forward

1. Enhance aviation infrastructure

UDAN Initiative

Complete the planned airports under the

UDAN initiativein a time-bound manner. Revival of 50 un-served and under-served airports/airstrips should be completed.In addition to completing two new airports for Delhi and Mumbai by 2022, the infrastructure capacity in the 10 biggest airports (in terms of traffic) should be significantly augmented.

Include provisions for domestic hub development while auctioning traffic rights.

2. Increase investment in the sector through financial and infrastructure support

MRO services Infrastructure Status

Reduce taxes on MRO services and consider granting infrastructure status for MRO.

Increase aircraft parking infrastructure and facilities at metro airports.

Create additional parking hubs at suitable locations, accessible through short haul flights, to accommodate additional aircraft.

Monetize vacant real estate near AAI airports in all major centres of traffic to increase non-aeronautical revenues.

3. Address shortage of skilled manpower

Promote Collaboration Between Stakeholders

Promote collaboration between original equipment manufacturers (OEMs), industry and educational institutes to teach the latest concepts in the aviation industry including management principles, IT in aviation, etc.

Formulate long-term plans for advanced research in aviation technologies to create a manufacturing ecosystem in the country.

Expedite commencement of courses by the National Aviation University after due consultation with stakeholders.

Facilitate greater involvement of the private sector in sponsoring aviation institutions, industrial training and R&D projects.

A further reduction in GST rates on Avgas will allow flying training organizations to make training more affordable.

4. Promote air cargo growth

“Fly-from-India”

Promote

“Fly-from-India”through the creation of transhipment hubs. The transhipment hub in Delhi is scheduled to be launched in May 2018 followed by the launch of those in Chennai and Mumbai.Develop an integrated digital supply chain or e-cargo gateway based on the National Air Cargo Community System (NACCS) platform.

The modular development may include the following digital business enablers as plug-ins:

e-contracting/bookingof cargo – with access to financial payment gateways.e-transportationmultimodality (road-air first/last mile connectivity).e-compliances(initially online clearances by six participating governmental agencies; rest to follow).Cargo Sewa– a grievance redressal module linked to Air Sewa.

5. Ease the regulatory environment for airports

Deregulate and Align Taxation

Deregulate further and open up the aviation market to help increase passenger and freight traffic in India.

Adopt a consistent model for tariff determination so that it reduces passenger cost.

Align taxation and pricing structure to global benchmarks by considering bringing aviation turbine fuel (ATF) under the rubric of GST.

Amend the AAI Act to allow commercial usage of land with airports by liberalising end-use restrictions for existing and future airports.

Strengthen regulatory capacity with respect to public private partnerships and streamline the judicial review process to ensure timely implementation of DGCA’s decisions.

Ensure that the DGCA acts as a truly independent regulator, with the Ministry of Civil Aviation focusing on policies.

Meet the regulatory and security requirements prescribed by the International Civil Aviation Organization (ICAO) at all times. Additional skilling of personnel may be required for this and the DGCA should adequately build the capabilities of its staff to ensure compliance.

6. Prioritize aviation safety

Safety - The Paramount Importance

Shift focus to pre-empting and preventing accidents/incidents.

There should be zero tolerance of safety violations.

DGCA should be given autonomy for an effective aviation safety oversight system. It should also be authorized to impose fines and penalties depending upon the nature of violations.

DGCA should continue ensuring real time safety tracking and prompt incident reporting.

DGCA should create a single-window system for all aviation related transactions, queries and complaints.